ITIN Online in Chrome with OffiDocs

Ad

DESCRIPTION

How to Apply for ITIN Your application must include all of the following: 1. Your completed Form W-7. Note.

If you submit a Form W-7, all ensuing ITIN notices and correspondence that you receive will be in English.

If you prefer to receive them in Spanish, please submit Form W-7(SP).

2. Your original, completed tax return(s) for which the ITIN is needed.

Attach Form W-7 to the front of your tax return.

If you are applying for more than one ITIN for the same tax return (such as for a spouse or dependent(s)), attach all Forms W-7 to the same tax return.

After your Form W-7 has been processed, the IRS will assign an ITIN to the return and process the return.

Note.

There are exceptions to the requirement to include a U.

S.

tax return.

If you claim one of these exceptions, you must submit the documentation required in lieu of a tax return.

See the Exceptions Tables.

3. The original documents, or certified or notarized copies of documents, that substantiate the information provided on the Form W-7. The supporting documentation must be consistent with the applicantпїЅs information provided on Form W-7. For example, the name, date of birth, and country(ies) of citizenship must be the same as on Form W-7, lines 1a, 4, and 6a.

Additional Information:

- Offered by secure.nyszone.com

- Average rating : 5 stars (loved it)

- Developer This email address is being protected from spambots. You need JavaScript enabled to view it.

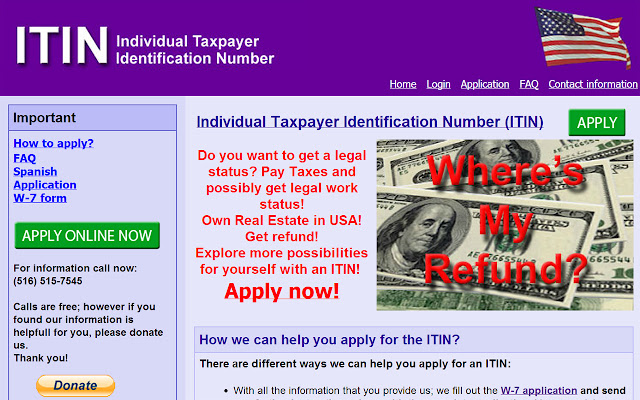

ITIN Online web extension integrated with the OffiDocs Chromium online

![Among Us on PC Laptop [New Tab Theme] in Chrome with OffiDocs](/imageswebp/60_60_amongusonpclaptop[newtabtheme].jpg.webp)